Managing the accounts payable (AP) process efficiently is essential for maintaining strong supplier relationships, controlling costs, and ensuring operational success. However, with increasing invoice volumes, manual AP processes often struggle to keep up, leading to inefficiencies, errors, and lost opportunities for savings. For finance leaders, tracking the right AP metrics is crucial not only for optimizing current operations but also for identifying areas of improvement.

Whether your goal is to shorten invoice processing times, reduce payment errors, or improve vendor relationships, monitoring key performance indicators (KPIs) can provide actionable insights to refine your AP strategy. By leveraging modern automation solutions, such as Zycus AI-led Accounts Payable Automation Software, companies can transform how they track and manage these metrics, driving efficiency and cost savings.

In this blog, we explore the top AP metrics you need to measure and track to ensure a streamlined, cost-effective, and future-proof AP operation.

What are Accounts Payable Metrics?

Simply put accounts payable metrics is a way to measure the efficiency of your AP function. Tracking metrics for day to day accounts payable function helps identify AP workflows that are underperforming or fail to meet the accounts payable metrics benchmark. A proper tracking of accounts payable KPI (key performance indicator) metrics can help businesses get a better understanding of suppliers, facilitate cost savings, enable them take informed strategic decisions, drive smart decisions, and over all business profitability.

However, the key is to track the right KPI metrics with accounts payable KPI dashboard to make accounts payable more efficient. So what are the metrics one should track? Let’s find out.

Gain insights into your finances with Accounts Payable KPI dashboard

Top Accounts Payable Metrics to Track

The metrics to be tracked may vary from one company to another depending on their goals for different AP functions. Accounts payable KPI metrics can be broadly classified in the below three categories:

1. Operational Metrics: All metrics related to the internal operations of a business and accounts payable such as employees, internal departments, processes set up to make payments.

2. Financial Metrics: Actual financial transactions that take place to process accounts payable such as fees, discounts, actual payments made, errors etc.

3. Supplier Metrics: Metrics pertaining to vendors or suppliers.

Let’s now delve into the accounts payable metrics that every business must track to make its accounts payable efficient and agile.

Operational Metrics

1. Number of Invoices Received

The first and foremost metric to track is the number of invoices a business receives and also how it receives it. By how we mean, clearly tracking the number of invoices received digitally and manually. The volume of invoices received is the starting point to decide how to work towards making your AP process more efficient. It also helps determine how AP automation tools can be implemented.

2. Exceptional vs Total Invoices Processed

This statistic monitors the mismatches or discrepancies that require verification or correction prior to processing for PO and non-PO invoices. This metric directly impacts processing costs and timing. It considers the percentage of overall invoices ending up in exception piles. Another way of measuring this metric would be ‘first-pass-match rate’ which would look at the percentage of invoices not getting stuck in exception piles.

3. Number of Invoices Processed

It is important to track the total number of invoices your AP team is able to process in a given time-period (say a week of per day), also number of invoices processed per employee in the AP team. If the numbers are low you really need to identify potential bottlenecks in the workflow or asses if your AP team is understaffed.

4. Average Invoice Processing Time

One can arrive at the average processing time by dividing the time taken to process the invoice by the total number of invoices received. A high processing time is an indicator of major gaps in your accounts payable efficiency. If you are still stuck in manual systems its time you consider moving to AP automation.

Formula: Time Spent Processing Invoices ÷ Number of Invoices Processed

5. Invoices Per FTE

This operational metric measures the number of invoices processed relative to the number of employees in the accounts payable department. This KPI may vary depending on whether a business is using paper invoices or has moved to e-invoicing software.

6. Payment Timeliness

On-time payment of invoices is essential to eliminate the late payment penalties as well to create prospects for early payment discounts and enrich relationships with suppliers. This metric calculates the percentage of overall invoices paid on time.

Financial Metrics

1. Payment Errors

Duplicate payments, delayed payments, excess payments all of these qualify as payment errors and can adversely impact supplier relationships and your reputation. A high number of payment errors is a clear indicator of a badly fractured AP workflow in need of immediate attention. This clearly is one of the most critical accounts payable metrics to track.

Formula: Number of Incorrect Payments ÷ Number of Invoices Paid

2. Payables Aging

The average number of days taken to settle supplier payments for their services is payables aging. A high number of days here is really like a double—edged sword. While it may be a good indicator of well-managed cash flow, consistent payment delays could lead to strained vendor relations.

Formula: Accounts Payable x Number of Days ÷ Cost of Goods Sold (COGS)

3. Percentage of Discounts Captured and Obtained

Percentage of discount captured refers to the number of discount offers a business receives for early payment. Percentage of discounts obtained refers to the payments done early to leverage the early payment discount and the number of such opportunities missed. Small discounts on multiple invoices if leveraged can cumulatively result in big cash savings and high-profit margins for a business. By tracking these metrics one can identify the reason for such opportunity loss and consider automation to make leverage early discounts a 100%.

Formula: Number of Discounts Captured ÷ Number of Discounts Offered

4. Process Cost Per Invoice

This metric is calculated by taking the direct monthly cost of accounts payable operation (excluding corporate overhead) and dividing that by number of invoices processed per month.

AP managers should be cautious of their cost per invoice and have an action plan to improve efficiency to drive this cost down.

Learn More: Merlin for AP Automation Software

Supplier Metrics

Vendor Disputes

Tracking number of vendor disputes is highly critical as it clearly indicates the health of your relationships with vendor and also gives deep insights on your accounts payable internal controls and processes. The most common reasons for vendor disputes could be wrong payment value, misplaced invoice, and clerical/data entry/manual errors at the time of processing.

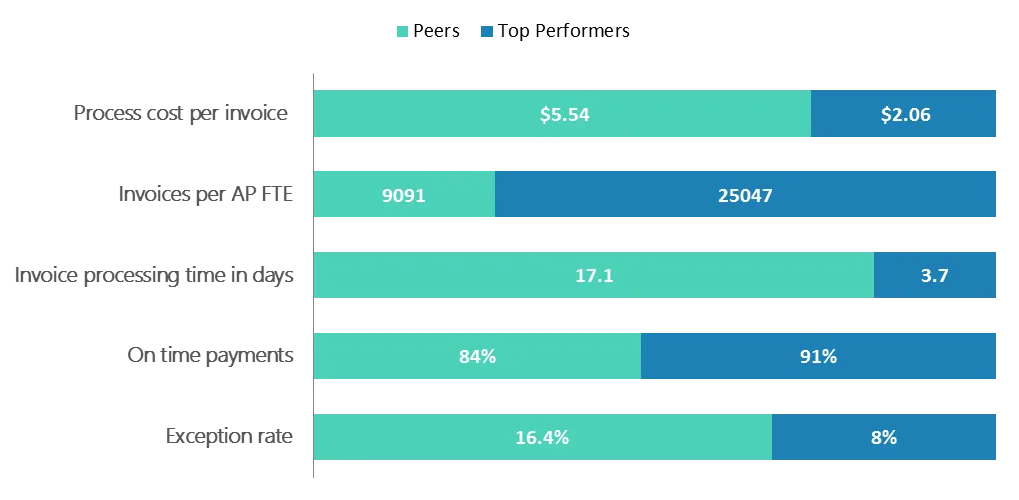

As per the industry best practices, here are some key statistics to keep in mind-

Source: Ardent Partners e-Payables

Zycus Solutions for Accounts Payable Automation

Zycus offers industry-leading AI-driven accounts payable automation that can transform your AP processes by leveraging advanced automation technology. Here’s how Zycus solutions can help improve your AP operations:

1. Streamlining Invoice Processing

With Zycus eProcurement Software, businesses can automate and digitize the entire invoice-to-payment workflow, reducing manual tasks and eliminating inefficiencies. Zycus’s eProcurement tools allow businesses to speed up invoice processing time by 75% and lower processing costs by 65%.

2. Supplier Management Integration

Zycus offers Supplier Management Solutions to enhance vendor communication and improve overall supplier relationships. This solution can help reduce vendor disputes, manage supplier data efficiently, and ensure better compliance with contract terms.

3. Error-Free Processing and Compliance

With Zycus’s E-invoicing Solutions, businesses can digitize invoicing processes, leading to touchless invoice approvals, minimized errors, and full regulatory compliance.

By integrating Zycus automation solutions, businesses can drive efficiency, improve vendor relationships, and reduce overall accounts payable costs.

Conclusion

Tracking the right accounts payable metrics is crucial for optimizing AP processes, enhancing financial health, and building stronger relationships with suppliers. Operational metrics like invoice processing time, financial metrics such as payment errors, and supplier-focused metrics like vendor disputes provide businesses with valuable insights into their AP performance.

Using advanced automation tools like Zycus AI-powered Accounts Payable Automation, businesses can significantly enhance their efficiency, reducing invoice processing time, minimizing errors, and improving supplier relationships. As industry forecasts predict a growing trend towards AI-driven procurement solutions by 2024 (source: Gartner), adopting these technologies is essential for staying competitive in the evolving business landscape.

By incorporating these key AP metrics and leveraging the power of automation through Zycus’s innovative solutions, organizations can achieve better financial control, ensure compliance, and drive sustainable growth in their accounts payable operations.

FAQs

Q: What is the significance of DPO (Days Payable Outstanding) in accounts payable?

DPO measures the average time a company takes to pay its suppliers, impacting cash flow and supplier relationships.

Q: How does the Invoice Processing Time metric affect a company’s efficiency?

It assesses how quickly invoices are processed from receipt to payment, highlighting operational efficiency and potential areas for improvement.

Q: Why is Cost per Invoice an important metric to track?

It helps understand and reduce the overall expenses associated with processing invoices, improving cost management.

Q: What does the metric of Early Payment discount utilization indicate?

It shows how effectively a company takes advantage of discounts offered for early payments, directly impacting cost savings.

Q: How does the Supplier Discrepancy Rate affect the accounts payable process?

A high discrepancy rate can indicate issues in the invoicing process or supplier inaccuracies, necessitating corrective actions to maintain smooth operations.

Related Read:

- Attributes of a Best-In-Class AP Operation- Part 1 of 3 – Cost & Time Optimization

- Attributes of a Best-In-Class AP Operation-Part 2 of 3 – Staff Productivity & Supplier Self-Service

- Attributes of a Best-In-Class AP Operation – Part 3 of 3 – Invoice Straight-Through Processing & Higher Discounts

- Tackling Increasing volume, Variety and complexity of E-invoicing

- How to Increase Accounts Payable productivity Without Increasing Headcount

- Why the Accounts Payable Turnover Ratio Matters for Your Business