Accounts payable (AP) function is a critical for any business, however, manual AP processing can be tedious and time-consuming. In fact, according to a survey by the Institute of Finance and Management (IOFM), the average accounts payable process takes approximately 14.5 days to complete. However, with AP workflow automation, businesses can transform their AP processes from a series of tedious tasks to automation-led time savings.

According to a survey by Ardent Partners, 55% of businesses cite manual data entry as the biggest challenge in their AP processes. In addition, the same study found that 44% of businesses struggle with the approval process, and 42% need help matching invoices to purchase orders.

This blog will explore the power of AP workflow automation and how it can help businesses streamline their AP processes, save time, and reduce costs.

TL;DR

- Manual AP is costly and slow: It takes an average of 14.5 days to process an invoice, creating inefficiencies and payment delays.

- AP workflow automation digitizes the process: From invoice capture to approvals and payments, automation reduces manual tasks and errors.

- AI and OCR improve accuracy: Automated systems scan, extract, and validate invoice data with minimal human intervention.

- Top benefits include: up to 81% cost savings, invoices processed 9x faster, fewer risks of fraud/duplicates, and stronger supplier relationships.

- Scalability is built-in: Automated AP systems handle growing invoice volumes without needing more staff.

- Zycus AP Automation Solution: AI-powered features like template-free processing, Smart Desk for supplier queries, fraud detection, and global compliance help finance teams achieve time and cost savings at scale.

What is Automated AP Workflow and How Does It Work?

An automated AP workflow replaces manual invoice handling with technology-driven steps that integrate directly with your accounting or ERP system. Instead of emails, spreadsheets, and manual approvals, invoices flow seamlessly through a digitized workflow:

- Invoices are captured and scanned with OCR/AI.

- Data is extracted and automatically validated.

- Approval requests are routed to the right stakeholders.

- Payments are authorized and scheduled.

- Exceptions are flagged for review.

- Reporting dashboards provide real-time insights.

The result? Faster cycle times, fewer errors, lower costs, and stronger financial control.

Why Businesses Need AP Workflow Automation

Manual accounts payable processes are time-intensive, error-prone, and costly. On average, it takes 14.5 days to process a single invoice (IOFM), creating bottlenecks that delay payments, strain supplier relationships, and increase financial risk.

With AP workflow automation, businesses can move from manual data entry and paper-heavy processes to intelligent, AI-driven systems. This not only improves efficiency but also provides real-time visibility into cash flow and compliance, giving finance leaders greater control over business outcomes.

Step-by-Step Accounts Payable Workflow Process

A workflow is a series of steps or activities to complete a specific tasks with an end-to-end process. In business, workflows are often used to standardize and streamline procedures to ensure consistent results and efficient operations.

Read more: How to get started with Automated AP Process?

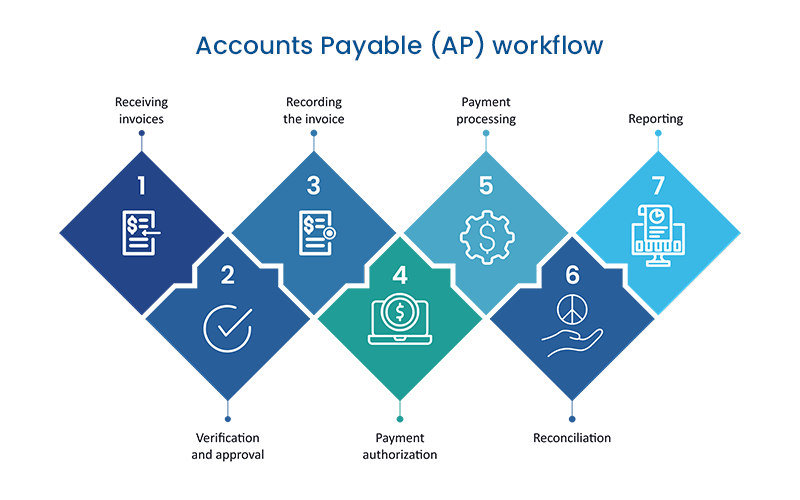

An Accounts Payable (AP) workflow is a series of steps to pay suppliers or vendors for goods or services a business has received. The AP workflow automation typically includes the following steps:

Receiving invoices:

The first step in the AP workflow automation is to receive invoices from suppliers for goods or services that have been received.

Verification and approval:

The invoice is then verified and approved by the relevant personnel in the organization. This may involve checking that the goods or services have been received along with the correct prices and quantities.

Recording the invoice:

The invoice is recorded in the organization’s accounting system.

Payment authorization:

Once the invoice has been approved and recorded, it is authorized for payment.

Payment processing:

Payment is made to the supplier according to the terms of the invoice. This may involve processing a check, initiating an electronic funds transfer, or other payment methods.

Reconciliation:

The payment is reconciled with the invoice and recorded in the organization’s accounting system.

Reporting:

Finally, the AP Workflow Automation generates reports on accounts payable activities, such as outstanding invoices, payment history, and other financial information. These reports can be used to track expenses and monitor cash flow.

Automated accounts payable (AP) workflows are technology-enabled processes that streamline the manual and repetitive tasks involved in the AP process, resulting in faster and more accurate processing of invoices and payments.

These workflows typically involve the use of software applications that integrate with an organization’s accounting system and other business applications to automate many of the steps involved in the AP workflow automation.

Top Benefits of AP Workflow Automation (expanded version)

Organizations that embrace workflow automation see transformative benefits across finance and operations.

- Standardization of Processes: Automation enforces workflows step-by-step, reducing human pushback and ensuring consistency.

- Faster Invoice Cycle Times: Businesses report invoices processed up to 9x faster than with manual methods (Ardent Partners).

- Cost Reduction: AP automation cuts processing costs by up to 81% (IOFM), freeing up resources for higher-value work.

- Reduced Risk of Errors and Fraud: Automated validation, PO matching, and audit trails prevent duplicate payments, phishing scams, and compliance issues.

- Improved Supplier Relationships: Faster payments build trust, improve supplier satisfaction, and help capture early-payment discounts.

- Scalability for Growth: Automated AP systems can handle thousands—or millions—of invoices without needing to add headcount.

Enhanced Features of Automated AP Workflows

Automated AP workflows streamline and automate various aspects of the AP process, leading to faster and more accurate processing of invoices and payments. These workflows offer advanced capabilities designed to maximize efficiency and minimize errors:

1. Invoice Scanning and Data Capture

Automated systems use optical character recognition (OCR) and AI-based data capture tools to automatically scan, extract, and digitize relevant invoice data. This process eliminates the need for manual data entry, reducing human error and expediting the data entry process.

Example: Instead of entering invoice information manually, the system captures vendor details, amounts, and dates automatically and uploads them directly into your AP system.

2. Automated Invoice Routing and Approval Workflows

Intelligent routing systems automatically forward invoices to the correct personnel for verification and approval based on pre-configured rules, such as invoice amount or department. Approvers are notified immediately, allowing them to review, approve, or reject invoices quickly.

Example: If an invoice exceeds a certain amount, it is automatically sent to a manager for approval, speeding up decision-making and preventing delays.

3. Purchase Order Matching

Three-way matching systems compare invoices, purchase orders (POs), and goods receipts to ensure the correct goods or services were delivered and billed appropriately. Any discrepancies between these documents are flagged for review, ensuring accuracy in billing.

Example: The system checks that the quantity and price on the invoice match the PO, reducing disputes with suppliers and enhancing billing accuracy.

4. Automated Payment Processing

Once an invoice is approved, the system automatically initiates payment processes, such as generating checks, initiating electronic funds transfers (EFTs), or setting up other forms of digital payment. This feature ensures timely payments, helping organizations avoid late fees and take advantage of early payment discounts.

Example: The system schedules payments automatically based on due dates, ensuring timely payments without manual intervention. Learn more about e-invoicing for paperless invoice management and streamlined payments.

5. Reporting and Analytics

Advanced real-time reporting dashboards provide visibility into the entire AP process, offering insights into outstanding invoices, payment statuses, and overall cash flow. Organizations can generate custom reports for in-depth analysis and better decision-making.

Example: A dashboard displays current and historical data on AP activities, helping financial teams track expenses, monitor compliance, and identify trends or bottlenecks that require action.

6. Exception Handling and Resolution

The system detects any exceptions—such as mismatches, duplicate invoices, or errors—and routes them to the appropriate team members for quick resolution. This reduces the need for manual interventions and ensures that the AP process continues smoothly without interruptions.

Example: If an invoice is identified as a duplicate, the system will flag it and prevent it from being processed, thereby reducing the risk of overpayments.

7. Compliance and Audit Trails

Automated AP workflows maintain comprehensive audit trails, tracking every action taken in the AP process, from invoice receipt to final payment. This ensures compliance with internal policies and external regulatory requirements, providing a secure and transparent process.

Example: Each step in the approval and payment process is logged, providing a complete audit trail for regulatory compliance or internal audits.

Read Our Latest Blog- The Ultimate Guide to Accounts Payable Automation

The benefits of AP workflow automation

When an organization implements AP workflow automation, it eliminates the confusion and inefficiencies of manual processes. Here are the top benefits:

1. Adherence to Workflows

Manual workflows are often not followed consistently. Automation ensures processes are followed step-by-step without human pushback, providing customizable workflows that dictate exactly what happens and when. If a team member is unavailable, automation reroutes tasks to avoid delays.

2. Increased Efficiency

AP automation significantly reduces the time needed to process invoices. According to Ardent Partners, businesses that automate their AP workflows can process invoices up to 9 times faster than those relying on manual processes.

3. Cost Savings

Automation also results in significant cost savings. IOFM reports that businesses automating their AP processes save up to 81% on invoice processing costs.

4. Reduced AP Risk

Automation provides visibility into the approval and payment processes, helping organizations track fraud, duplicate payments, and suspicious activity. Systems automatically flag duplicate invoices, extra charges, and unapproved vendors, protecting businesses from phishing scams, unauthorized payments, and other common risks.

5. Scalability for High-Volume Invoices

Enterprises handling high invoice volumes often face challenges in scaling manual processes. Traditional methods like optical character recognition (OCR) struggle with variations in document layout, leading to low straight-through processing (STP) rates. AP automation eliminates this bottleneck, allowing businesses to scale efficiently without the need for additional full-time employees (FTEs).

Zycus AP Automation Solution

The Zycus AP Automation Solution targets holistic AP transformation and leverages the artificial intelligence (AI)/machine learning capabilities (ML) of the Zycus AI platform. Key features and capabilities of the Zycus AI-led AP Automation Solution include:

Time and cost savings:

A template-free approach that delivers improved rates of straight-through processing with high accuracy and relatively low total costs of ownership (TCO)

Better supplier communications:

Automated email review and reply via AP Smart Desk that improves supplier satisfaction and strengthens buyer-supplier relationships with faster response times and no missed emails

Anomaly and fraud detection:

Identification of potential fraud cases (duplicate invoice, phantom supplier, etc.) plus safeguards against phishing and spoofing

Global Compliance:

Consistent and up-to-date support for compliance around invoice content, e-invoice, and tax regulations.

Conclusion

AP workflow automation is more than just a technology upgrade—it is a strategic decision that drives efficiency, cost savings, and risk reduction across the AP function. By automating tasks such as invoice scanning, routing, approval, and payment, businesses can significantly reduce manual work, eliminate errors, and accelerate processing times. Solutions like e-invoicing and workflow management enhance visibility, compliance, and control, empowering businesses to streamline their entire AP process.

Implementing AP workflow automation enables organizations to focus on higher-value tasks and strengthens overall financial management. By removing manual bottlenecks, companies can position themselves for greater efficiency and profitability.

Schedule a demo and find out how Zycus can assist you with Accounts Payable automation!

FAQs

Q1. What is AP workflow automation?

AP workflow automation uses software to digitize and streamline the accounts payable process. It automates tasks such as invoice capture, validation, approvals, and payments, reducing manual effort and improving accuracy.

Q2. Why is AP workflow automation important for businesses?

Manual AP processes are slow, costly, and error-prone. Automation cuts invoice processing time from weeks to days, lowers costs by up to 81%, improves compliance, and strengthens supplier relationships.

Q3. Which tasks can be automated in the AP process?

Commonly automated tasks include invoice scanning and data capture, purchase order (PO) matching, approval routing, payment scheduling, reporting, and exception handling.

Q4. How does AI improve AP workflow automation?

AI and OCR technologies enable accurate invoice data extraction, detect anomalies and fraud (e.g., duplicate invoices or phantom suppliers), and provide predictive analytics for cash flow management.

Q5. What are the biggest benefits of AP workflow automation?

Key benefits include faster invoice cycle times, significant cost savings, reduced risk of fraud, enhanced compliance, better supplier communication, and scalability for high-volume transactions.

Q6. Is AP workflow automation only for large enterprises?

No. Automated AP systems scale easily, making them suitable for small and mid-sized businesses (SMBs) as well as enterprises. Businesses of all sizes benefit from reduced manual effort, cost savings, and improved financial visibility.

Q7. How does Zycus AP Automation Solution stand out?

Zycus leverages AI and machine learning to deliver template-free invoice processing, real-time anomaly detection, Smart Desk for automated supplier query handling, and consistent global compliance support.

Related Read:

- What is Invoice Approval Workflow?

- Combat the perils of Non-PO invoices by Invoice Workflow Automation

- Accelerate Your Invoice Processing with Invoice Approval Workflow Software

- Top 5 Proven Accounts Payable Best Practices in 2023

- Top 7 reasons to Digitize Accounts Payable

- What is Dynamic Discounting?

- Save Time and Reduce Errors with AP-Workflow Software

- Research Report – Invoice Workflow Automation (IWA) Report