Procurement leaders have always known tail spend is messy — but in 2025, it has become impossible to ignore. The Hackett Group’s 2025 Tail Spend Management Study confirms the urgency: only 4% of companies actively manage most of their tail spend, while executives believe 16–20% savings is possible if managed strategically.

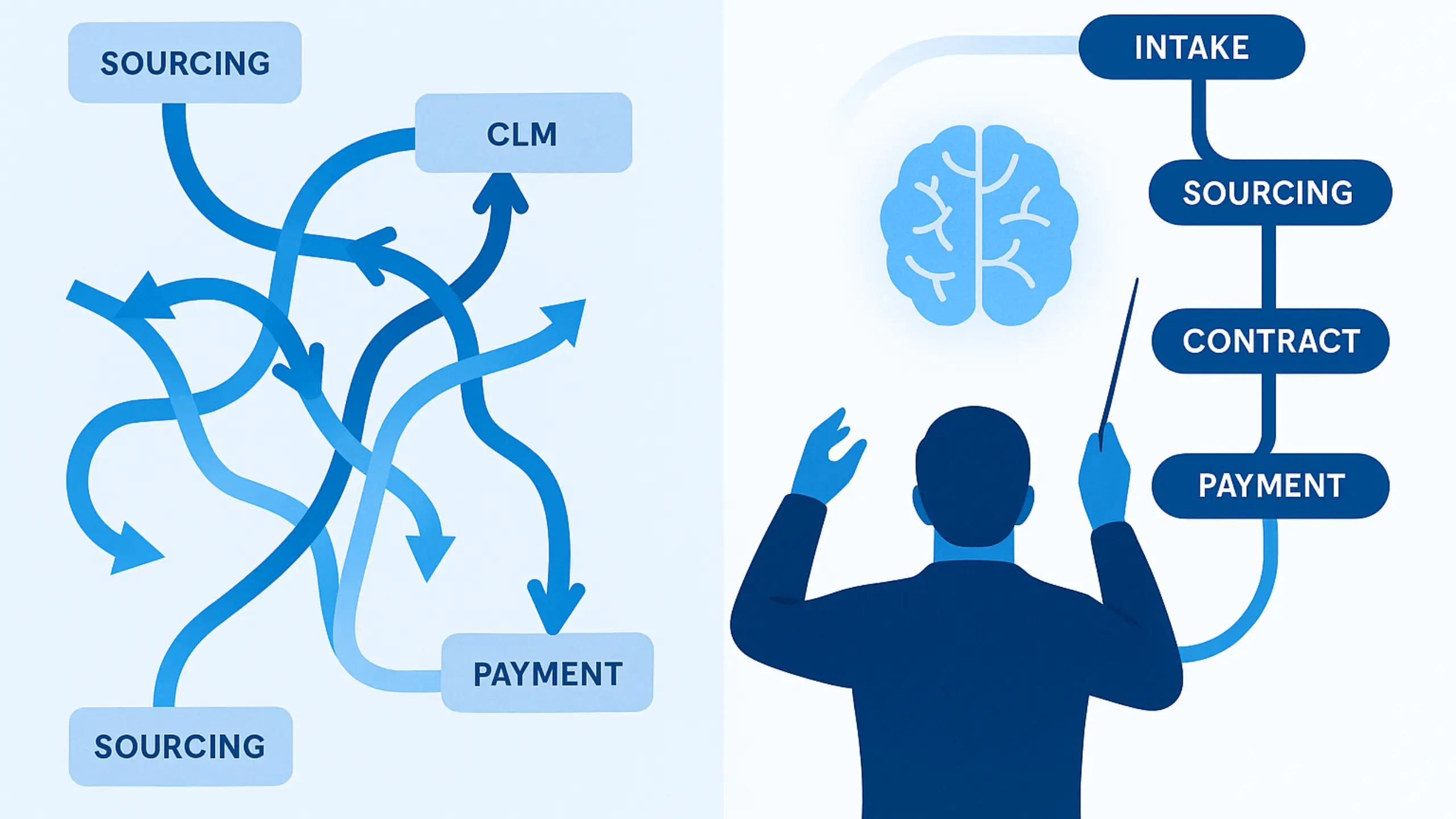

So, how do we move from unmanaged chaos to orchestrated value creation? The answer lies in intelligent intake, AI-powered negotiation, and supplier adoption at scale.

This blog builds on our earlier explorations of tail spend (see: The Silent 20%), the failures of marketplaces and P-cards, and why boards are now demanding answers. Here, we outline the end-to-end roadmap for transformation, anchored in Zycus Merlin Intake and Autonomous Negotiation Agents (ANA), with proof points from enterprises like Tata Play.

Why Procurement Needs a Tail Spend Roadmap

Tail spend has been covered in depth across this series:

- Tail vs. Tactical vs. Maverick Spend: Why confusion in definitions causes strategy gaps.

- The Silent 20%: How unmanaged spend erodes value.

- Why Marketplaces, P-Cards, and BPOs Failed: Why legacy fixes fall short.

- From Chaos to Control: Agentic AI: How AI reframes the problem.

- Top 3 Categories Bleeding Value: Where procurement should focus first.

- Why Tail Spend Is Now a Board-Level Priority: Why executives are demanding change.

Together, these insights reveal a clear message: procurement leaders cannot afford to leave tail spend unmanaged any longer.

How Zycus Merlin Intake Creates the Foundation

The first step in tail spend transformation is ensuring every request enters through a controlled, policy-driven workflow.

Merlin Intake solves this by:

- Guided Buying: Business users raise requests in natural language, and the system routes them to approved suppliers.

- Embedded Compliance: ESG, tax, and policy rules are enforced upfront.

- Seamless Experience: Works natively inside tools like Microsoft Teams, driving user adoption.

As we explored in Blog 6: Top Categories Bleeding Value, categories like office supplies and facilities are notorious for unmanaged leakage. Merlin Intake captures them at the source before they fragment further.

How Zycus ANA Agents Scale Procurement Negotiations

Once requests are captured, the next challenge is value capture. This is where Autonomous Negotiation Agents (ANA) come in.

ANA delivers what human teams cannot:

- Parallel Negotiations: Run thousands of supplier interactions simultaneously.

- AI-Driven Tactics: Adjust strategy based on category benchmarks and supplier behavior.

- Savings at Scale: Close the aspiration gap highlighted in the Hackett report landing page.

As discussed in Blog 3: Why Marketplaces, P-Cards, and BPOs Failed, tactical fixes lacked orchestration. ANA ensures orchestration by negotiating systematically across the long tail.

Proof Point: Tata Play’s Tail Spend Journey

A powerful demonstration of this roadmap comes from Tata Play, a leading media services provider.

Watch the Tata Play case study video here

Results achieved by Tata Play:

- Consolidated fragmented tail suppliers into a manageable pool

- Increased compliance across decentralized buying units

- Freed up procurement resources by letting ANA handle repetitive buys

- Elevated procurement’s credibility with business stakeholders

For more customer proof, see Zycus Customer Success Stories.

Which Categories Should Be Prioritized First?

Boards and CFOs often ask: “Where do we begin?”

According to Hackett and explored in Blog 5: The Satisfaction Paradox, dissatisfaction is highest in:

- Office Supplies (high volume, low oversight)

- Facilities Maintenance (reactive, fragmented)

- Marketing Services (opaque, decentralized)

Starting here demonstrates tangible ROI that procurement can showcase in executive reviews.

Driving Supplier Participation in AI-Led Negotiations

A common concern is: “What if suppliers don’t play along?” As we argued in Blog 4: From Chaos to Control, adoption is achievable with the right levers:

- Transparent Communication: Suppliers know how the AI agent works.

- Incentives: Faster payments or preferred status for compliant vendors.

- Hybrid Flexibility: Escalation to human buyers for exceptions.

This ensures suppliers not only accept AI-led negotiations but prefer them.

Why Tail Spend Is Now a Board-Level Priority

Finally, boards are demanding visibility. As highlighted in Blog 7: Reality Check 2025:

- Tail spend erodes 2–3% of EBITDA annually (Bain).

- Compliance gaps in ESG reporting put enterprises at risk.

- AI has raised expectations — executives ask why it isn’t being applied here.

By adopting Intake + ANA, procurement can go to the board with a simple message: “Tail spend is under control, delivering savings, compliance, and risk reduction.”

Key Takeaways for Procurement Leaders

- The Hackett Group 2025 study shows dissatisfaction with current tail spend approaches is widespread.

- Previous blogs in this series explored what tail spend is, why legacy fixes failed, where categories bleed value, and why boards care.

- Zycus offers the end-to-end roadmap: Merlin Intake to capture spend, ANA agents to scale negotiations.

- Real-world proof: Tata Play demonstrates the impact today.

- Procurement leaders who act now can close the aspiration gap — moving from 7–10% savings today to 16–20%.

Next Steps

Download The Hackett Group 2025 Tail Spend Management Study to benchmark your tail spend strategy.

Related Reads:

- Top 3 Procurement Categories Bleeding Value in Tail Spend — And How to Fix Them

- Podcast: From Neglected to Negotiated: How Agents Captures More than $50M in Tail Spend

- A Comprehensive Guide to Spend Management

- The Procurement Satisfaction Paradox: Why 64% of Leaders Still Dislike Their Tail Spend Approach

- The Silent 20%: Why Tail Spend Is Procurement’s Hidden Goldmine

- 5 Key Benefits of Automating Tail Spend Management

- Reality Check 2025: Why Tail Spend Is Now a Board-Level Procurement Priority