For years, tail spend lived in the shadows of procurement strategy. Small transactions, fragmented suppliers, and indirect categories were treated as tactical annoyances rather than strategic levers. But in 2025, the landscape has shifted.

The Hackett Group’s 2025 Tail Spend Management Study shows that 80% of procurement leaders now say tail spend has become more important to their enterprise strategy. Once dismissed as “too small to matter,” tail spend is finally making its way into boardroom discussions.

Why the sudden change? And what should procurement leaders be prepared to answer when their boards start asking questions?

Why Tail Spend Has Become a Board-Level Procurement Issue

Several forces are driving this elevation:

1. Margin Pressure

-

- With inflation and supply chain volatility, CFOs are scrutinizing every dollar.

- Bain & Company notes that unmanaged indirect spend can erode 2–3% of EBITDA annually — a figure boards can’t ignore.

2. Compliance & ESG Risks

-

- Unmanaged suppliers often slip through compliance checks, creating exposure.

- In Europe, ESG regulations mean tail suppliers must now be tracked for sustainability reporting.

3. Supplier Risk

-

- Fragmented tail suppliers increase cyber, financial, and operational risk.

- Deloitte research highlights that unmanaged supplier tiers are where most hidden risks reside.

4. AI & Automation Visibility

-

- Boards increasingly ask: “If AI can run negotiations, why aren’t we applying it to tail spend?”

What Questions Are Boards Asking Procurement Leaders About Tail Spend?

Boards are not interested in catalog details; they want strategic clarity. Typical questions include:

- “How much value leakage do we have in unmanaged tail spend?”

- “Which categories are most exposed to compliance or ESG risks?”

- “What savings upside is achievable, and how fast can we capture it?”

- “How are we using AI and automation to improve control?”

- “What risks exist if we continue unmanaged practices?”

Procurement leaders need to be ready with data-backed answers. Download the Hackett 2025 Tail Spend Study for benchmarks.

What Challenges Will Procurement Face When Elevating Tail Spend to the Board?

Even as boards push for visibility, procurement leaders face hurdles:

- Data Fragmentation: Tail transactions are scattered across P-cards, local contracts, and business units.

- Low Internal Awareness: Stakeholders may not see small purchases as risky, making change harder.

- Supplier Pushback: Smaller vendors may resist new AI-driven processes.

- AI Readiness: Governance and ethics frameworks must be defined before AI can scale.

Gartner warns that “AI in procurement without governance risks automating errors at scale” — exactly the kind of issue boards will want assurance against.

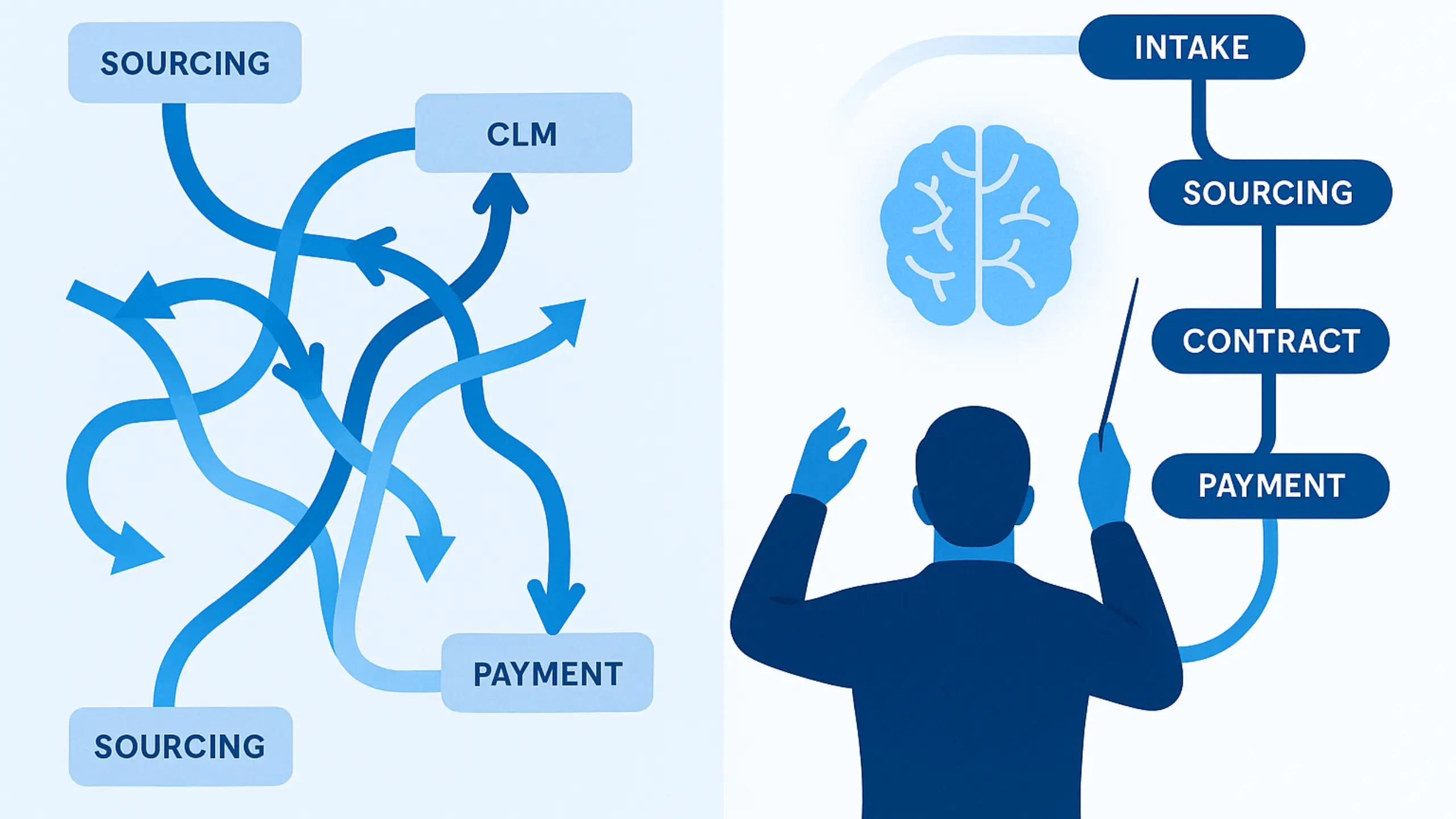

How Agentic AI Reframes Tail Spend for the Board

Agentic AI moves the conversation from firefighting to control. Instead of explaining why tail spend is hard to manage, procurement leaders can now show how it can be orchestrated.

- Guided Intake ensures all tail requests are captured at the source (Merlin Intake).

- Autonomous Negotiation Agents deliver savings at scale for small-value transactions (ANA).

- Embedded Compliance guarantees ESG, tax, and policy rules are applied in real time.

- IBM Services provide global execution and category depth to scale programs fast.

This allows CPOs to tell the board: “Tail spend is under control, governed by AI, and delivering measurable savings and compliance.”

Which Tail Spend Categories Should Be Highlighted to the Board?

Boards want concrete examples of exposure and opportunity. Procurement leaders should highlight:

- Office Supplies → Demonstrates fragmented buys and potential consolidation.

- Facilities Maintenance → Shows governance impact on cost and risk.

- Marketing Services → Illustrates how procurement can bring transparency to strategic but unmanaged categories.

By linking categories to board-level concerns (cost, risk, ESG), procurement elevates the conversation from transactional to strategic.

How to Drive Vendor Participation in AI-Led Tail Spend Programs

Boards may ask: “What if suppliers don’t play along?” Procurement leaders should show a clear plan for supplier adoption:

- Communicate Benefits → faster payments, transparent negotiations.

- Offer Incentives → preferred supplier status or early-payment discounts.

- Hybrid Approach → AI handles standard buys; humans handle exceptions.

Bain research confirms that supplier adoption rates increase by 25–30% when vendors see tangible benefits and flexibility.

Tail Spend Procurement Trends by Region (US, Europe, APAC, LATAM)

- North America: CFOs push tail spend to boards due to P-card leakage.

- Europe: ESG and compliance regulations elevate tail spend visibility.

- APAC: Transaction volumes make automation ROI highly visible to boards.

- LATAM: Supplier informality makes governance a priority at the top.

Key Takeaways for Procurement Leaders

- Tail spend is now a board-level procurement issue, not just a tactical one.

- Boards demand clarity on leakage, compliance risks, and AI adoption.

- Procurement faces challenges around data, supplier adoption, and governance — but these can be solved.

- Agentic AI reframes the narrative, delivering control, compliance, and savings at scale.

- Leaders should highlight specific categories (office supplies, facilities, marketing) to make the case tangible.

Next Steps

Download The Hackett Group 2025 Tail Spend Management Study for data to share with your board.

Related Reads:

- Agentic AI for Procurement Tail Spend Management

- The Silent 20%: Why Tail Spend Is Procurement’s Hidden Goldmine

- 5 Key Benefits of Automating Tail Spend Management

- From Chaos to Control: How Agentic AI Is Rewriting the Rules of Tail Spend

- Top 3 Procurement Categories Bleeding Value in Tail Spend — And How to Fix Them

- Podcast: From Neglected to Negotiated: How Agents Captures More than $50M in Tail Spend

- A Comprehensive Guide to Spend Management

- The Procurement Satisfaction Paradox: Why 64% of Leaders Still Dislike Their Tail Spend Approach